GCC Financial Analysis Report & Market Data.

A robust financial analysis report for the GCC region must look beyond oil price correlations to decode the structural reforms reshaping capital markets. The Gulf is currently experiencing a "Golden Age" of IPOs, driven by the privatization of state assets and the deepening of local equity markets. Ghost Research delivers the "Authority" view on these dynamics, dissecting the liquidity flows, valuation premiums, and foreign institutional investor (FII) participation rates across Tadawul, ADX, and DFM.

We synthesize data from thousands of sources to provide a clear, unvarnished picture of the market’s trajectory. From the rise of green sukuk issuance to the consolidation of the insurance sector, our intelligence equips investors and consultants with the foresight needed to capitalize on the region’s financial maturation. Trust Ghost Research to deliver the rigorous, data-backed analysis required to secure a competitive edge in the Gulf’s high-stakes capital markets.

GCC Financial Analysis Report – Investment & Policy Watch.

GCC Financial Analysis Report – Investment & Policy Watch.

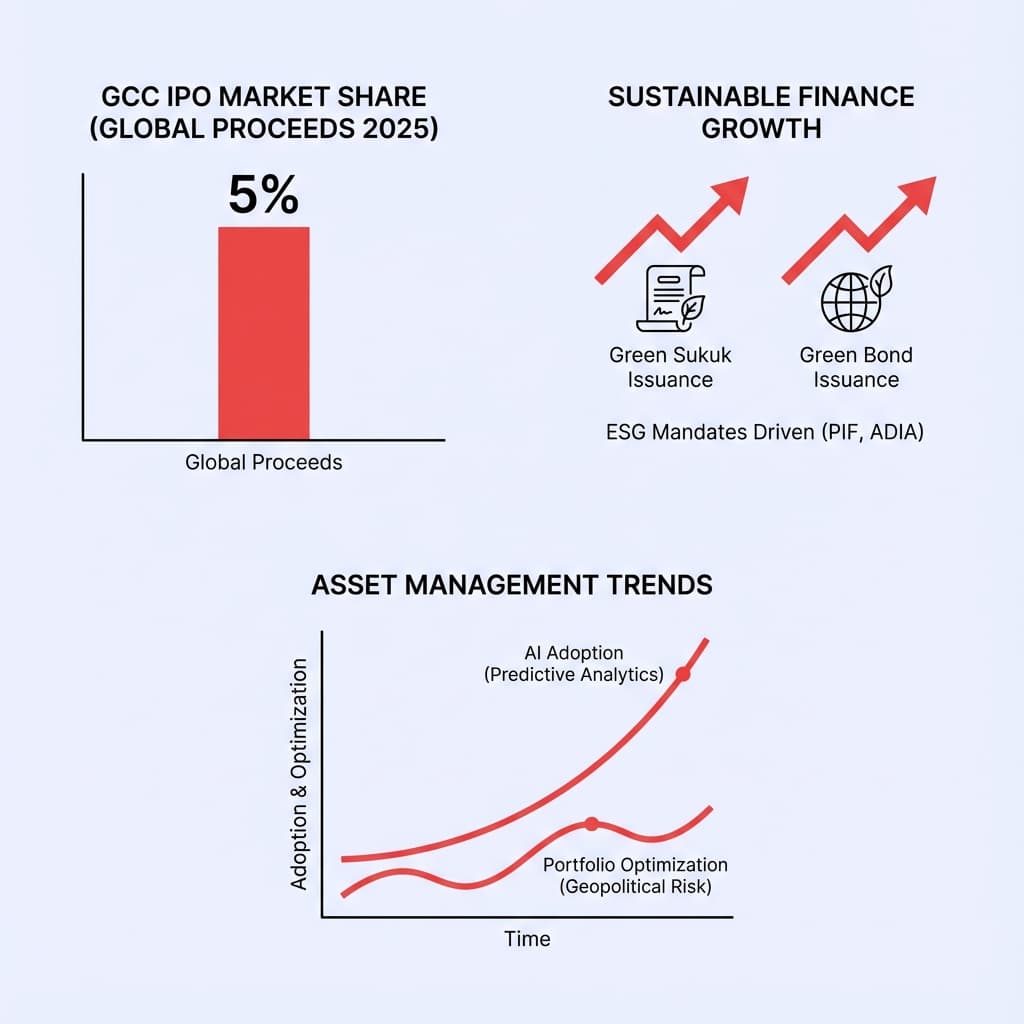

The Gulf Cooperation Council (GCC) financial markets are entering a phase of institutional maturity, characterized by a decoupling from global macro volatility and a surge in domestic liquidity. Our latest financial market data analysis highlights that the region accounted for over 5% of global IPO proceeds in 2025, a testament to the success of Saudi Arabia’s Vision 2030 privatization agenda. This wave of listings is not merely a capital-raising exercise; it is a strategic deepening of the market, introducing diverse sectors like healthcare, logistics, and technology to exchanges previously dominated by petrochemicals and banks.

A comprehensive financial research report for this quarter underscores the pivotal role of sustainable finance. With sovereign wealth funds like the PIF and ADIA mandating ESG compliance, we are witnessing a boom in green bond and sukuk issuances, positioning the GCC as a global hub for transition finance. For a financial market analyst, the key trend to watch is the rapid adoption of AI in asset management, where predictive analytics are being used to optimize portfolios against geopolitical risk.

The finance market analysis suggests that while valuations remain attractive relative to developed markets, active selection is crucial as performance dispersion widens. The market is bifurcating between government-backed national champions, which trade at a premium, and mid-cap private enterprises offering growth at a discount. Investors must leverage financial business analysis to identify firms with robust corporate governance frameworks capable of attracting sustained foreign institutional capital.

Explore Other Sectors in gcc.

Explore Other Sectors in gcc.

Discover how other industries are evolving in this region. Select a geography and sector combination to explore targeted market research.

GCC Energy Market Trends

Explore critical energy market trends in the Gulf, focused on oil price dynamics, diversification, and the rapid scaling of clean energy projects.

5 reports

GCC IT Market Overview

Get a complete IT market overview for the GCC, analyzing smart city initiatives, cloud migration, and government digital mandates.

9 reports

GCC Healthcare Industry Reports

Get authoritative healthcare market research reports on the GCC, covering mandatory insurance, privatization, and medical tourism trends.

11 reports

GCC Real Estate Market Analysis

Get precise real estate market analysis for the GCC, tracking the impact of economic diversification on property valuations and off-plan sales.

15 reports

Why Ghost Research.

Why Ghost Research.

We pair AI-powered discovery with human expertise, ensuring every insight is timely, contextual, and decision-ready. That’s research you can rely on.